June 28, 2024

Hong Kong is Asia's most expensive construction market to build

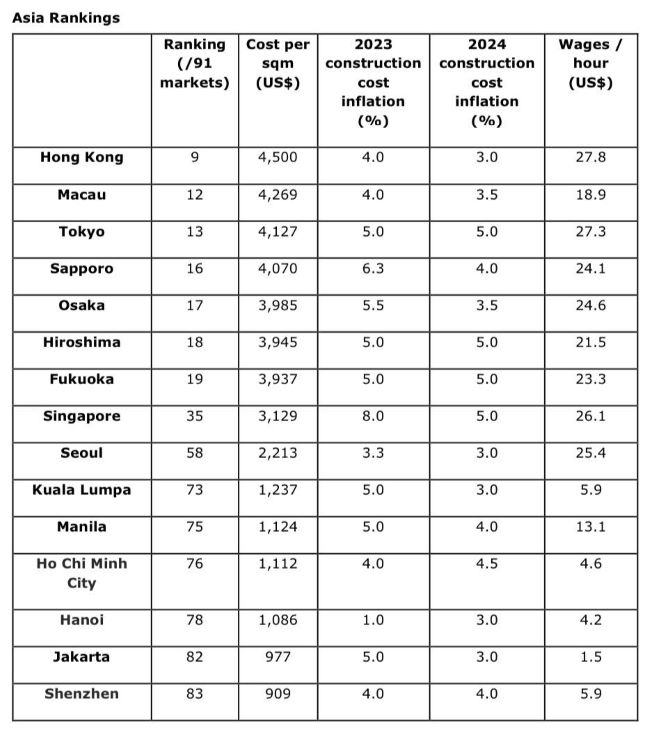

Hong Kong and Macau are Asia’s most expensive construction markets to build in this year at $4,500 and $4,269 per m2 respectively – and the ninth and 12th most expensive cities globally. The economic slowdown in China and rise in nearshoring activities worldwide are opening up new construction opportunities for key emerging markets in Asia with Malaysia, Indonesia and India all benefitting.

Meanwhile, as developed markets in the region adjust to both macroeconomic and domestic challenges, Hong Kong re-enters the top 10 list of most expensive markets to build in globally, in ninth place, with an average cost of US$4,500 per m2, followed closely by Macau in 12th with an average cost of US$4,269 per m2.

The International construction market survey (ICMS) 2024 report, from global professional services company Turner & Townsend, shows that while construction still faces challenges, inflationary pressure is softening, and stabilising costs are allowing investment flow in key global growth sectors such as data centres, healthcare and manufacturing.

From a survey of 91 global cities, with the exception of Hong Kong and Macau, all Chinese markets languish near the bottom of the overall cost table. China’s GDP growth is forecast to slow to 4.6 percent in 2024 from 5.2 percent last year as the country’s abundant labour force continues to keep costs low across its mainland markets.

A significant factor driving inflation worldwide is a scarcity of skilled labour. A staggering 79.1 percent of markets, representing 72 individual markets, reported skill shortages. This stands in stark contrast to just 9.9 percent, or 9 markets, with a labour surplus. The remaining 11 percent, or 10 markets, indicated a balanced labour market. This imbalance between supply and demand for skilled workers is putting continued upward pressure on construction costs globally.

Overall, the data points to lowering construction price inflationary pressure globally. Turner & Townsend has modestly reduced its 2024 construction cost inflation forecasts compared to last year. Construction cost inflation in most markets is driven by a backlog of projects, which are gradually moving forward as construction costs stabilise.

|

|